How To Buy Crypto as a Gift?

Nowadays, more and more people are investing in, paying with, and even gifting crypto. While buying crypto is easy, gifting it can feel confusing. So, how do you buy crypto as a gift for someone? Do you need to set up a wallet or an account for the recipient? Is two-factor authentication required? Does the process involve long, complicated steps?

If you’ve ever wondered how to buy crypto as a gift without the hassle, you’re in the right place.

Read on to discover the simplest way to do it.

How to buy Crypto as a Gift?

1. Wealthy Wishes Gift Wallets

The most exciting way to buy crypto as a gift is by purchasing Wealthy Wishes Gift Wallets.

What are Wealthy Wishes Gift Wallets?

Wealthy Wishes Gift Wallets are a unique way to gift crypto to someone without any setup required. You simply tap the card to the back of your phone, activating NFC technology to generate your unique private and public keys. Then, set up your PIN, load any amount of crypto you want, and you’re ready to gift. It’s that easy!

Simply gift crypto to anyone. Order Wealthy Wishes Gift Cards Now!

2. Paper Wallets

Another way to gift crypto is by creating a paper wallet and gifting them the private keys.

However, be cautious! Never show anyone the private keys, and ensure the paper wallet doesn’t get damaged (keep it dry and safe). Afterward, transfer the crypto from your wallet to the newly created paper wallet.

You can use a wallet generator to easily create a paper wallet and gift it.

3. Crypto Exchange

This method is more suitable for those who may not already have a wallet. However, it’s still an easy and safe way to transfer crypto to your loved one.

If you don’t have an account, you’ll need to set one up. Here’s how:

1.Pick a reputable exchange that suits your needs. Some popular options include:

- Binance

- Coinbase

- Kraken

- Bybit/OKX

2. Sign Up for an Account

- Visit the exchange’s official website.

- Click Sign Up or Register and enter your email and password.

- Some exchanges let you sign up using your phone number.

3. Verify Your Identity (KYC Process)

Most exchanges require Know Your Customer (KYC) verification to comply with regulations.

- Upload a government-issued ID (passport, driver’s license, or ID card).

- Take a selfie for identity verification.

- Provide proof of address (utility bill or bank statement).

- Some exchanges process KYC instantly, while others take a few hours or days.

4. Secure Your Account

- Enable Two-Factor Authentication (2FA) using Google Authenticator or SMS.

- Use a strong password and avoid using the same password as other accounts.

5. Deposit Funds

Once your account is verified, you can fund it:

- Bank Transfer (SEPA, Wire Transfer, etc.)

- Credit/Debit Card (Some exchanges allow instant purchases)

- Crypto Deposit (Transfer from another wallet or exchange)

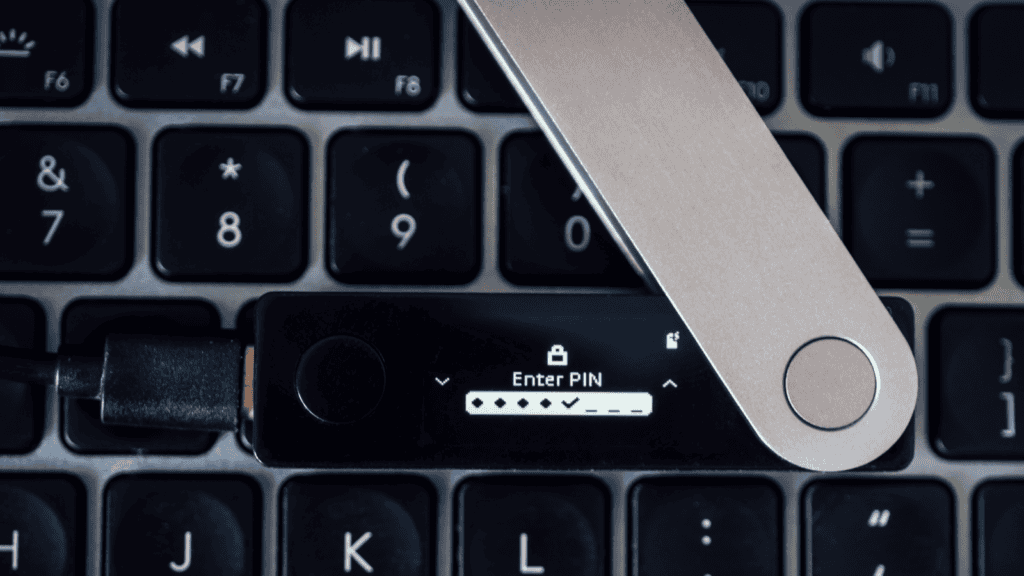

3. Hardware Wallets

A hardware wallet is a physical device, often resembling a USB drive, that provides a secure way to store cryptocurrencies. It keeps a user’s private cryptographic keys in offline or “cold” storage, safeguarding them from online threats. These wallets don’t store the crypto itself but rather the keys needed to access it.

To gift crypto using a hardware wallet, simply buy and set up a device like a Ledger or Trezor. Securely record the seed phrase provided, then purchase crypto and transfer it to the wallet. Finally, gift the wallet along with the seed phrase to the recipient for secure access.

How are crypto gifts taxed?

In most countries, crypto gifts are subject to two main types of taxes: gift tax (for the giver) and capital gains tax (for the recipient when selling).

Do You Pay Tax When Gifting Crypto?

In many countries, crypto gifts follow the same rules as cash or property gifts:

- No tax if the gift is under a certain limit. Many countries allow tax-free gifts up to a threshold.

- Above the limit? The giver may need to report or pay gift tax.

Examples of Gift Tax Limits:

- USA: Gifts above $18,000 (2024 limit) require filing a gift tax return.

- UK & Germany: No direct gift tax, but selling gifted crypto may trigger capital gains tax.

- EU Countries: Tax rules vary; some have exemptions for family gifts.

2. Does the Recipient Pay Tax?

The person receiving the crypto does not pay tax immediately. However, if they sell it later, they might owe capital gains tax on any profit.

Example:

- You receive 0.1 BTC as a gift when it’s worth €5,000.

- A year later, you sell it for €7,000.

- You may owe tax on the €2,000 profit.

3. How to Reduce Taxes on Crypto Gifts

- Keep gifts below tax-free limits to avoid extra reporting.

- Use family exemptions (some countries allow tax-free gifts between relatives).

- Hold crypto longer before selling to qualify for lower long-term capital gains tax rates.

- Consider gifting through a trust if you plan larger crypto transfers.

Tax laws change frequently! Check with a tax professional in your country for the latest regulations.

FAQ

Can crypto be given as a gift?

Yes, you can gift crypto by sending it to someone’s wallet or using crypto gift wallets like Wealthy Wishes.

How do you gift crypto to a friend?

You can gift crypto by:

- Sending it to their wallet address

- Buying a crypto gift card

- Setting up a hardware wallet with preloaded crypto

How do I pay crypto to someone?

Easily send crypto to their wallet address by scanning their QR code or using a trusted payment platform like BitPay or Binance Pay for a seamless transfer experience.